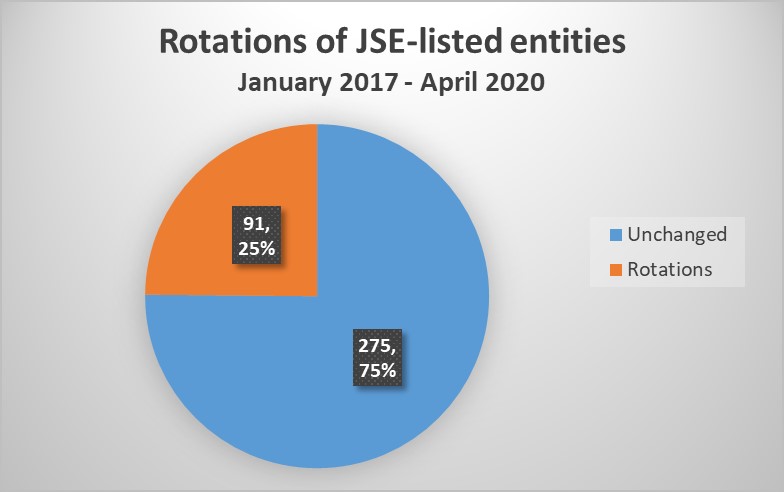

25% of JSE-listed entities have rotated audit firms ahead of 2023 MAFR deadline

|

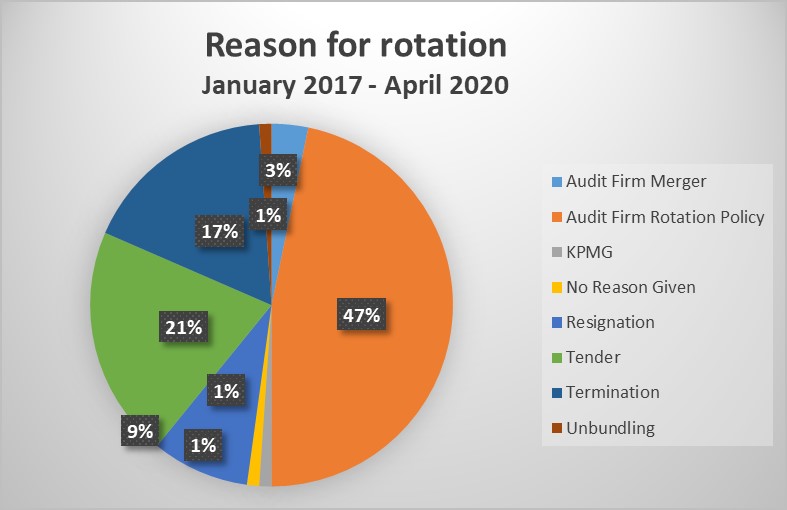

Johannesburg, Sunday, June 21, 2020 – The Independent Regulatory Board for Auditors (IRBA) has published the latest statistics on the progress of Mandatory Audit Firm Rotation (MAFR) since the regulation was promulgated in 2017 and notes that a quarter of Johannesburg Stock Exchange companies have rotated audit firms as at end April 2020. Of those who have rotated in that time, 47% cite the early adoption of MAFR as the reason for the rotation. The IRBA mandated audit firm rotation in 2017 following audit failures resulting from a lack of independence and lengthy tenures of audit firms with the same clients, in some instances exceeding 100 years. The risk with long tenure, whether real or perceived, is that the relationship between the client and the firm becomes ‘cosy’, which could compromise auditor independence and the appropriateness of the auditor’s opinion on clients’ financial statements. On the matter of open access to next tier firms and black-owned firms, audits have rotated to a number of firms outside the big four, and there has been some partnering between big four and black-owned firms. Says Bernard Agulhas, CEO of the IRBA: “We are very pleased to see that rotations are not limited to changing between the big four and are confident that we will see this trend continuing. Increased access to work on listed entities will enhance the depth of experience at next-tier and black-owned firms. “We have noted some audits rotating to firms such as BDO, PKF Octagon, Mazars, RSM, SNG GT and Ubucule. Also, we are pleased to see that both EY and PwC have joined with SNG GT and won joint audit business. Another new joint audit pairing being Thawt Incorporated and Crowe JHB also recently won two audits in the listed market. As there is very little past experience of joint audit arrangements outside of the banking sector, the IRBA has been developing a Guide to Joint Audits which is at an advanced stage. Such guidance will go a long way to assisting audit firms to agree and formulate sound working arrangements around a joint audit.” The effective date for MAFR is 1 April 2023 and applies to all companies whose audit firm tenure is ten years or more at that date; there are therefore some advantages for those companies which have opted to rotate early. Says Agulhas: “The benefit for those companies which have already rotated is that they will not be impacted by the effective date of 1 April 2023, since their audit firm’s tenure will be far less than the maximum ten years. For these entities they will only be required to rotate again between 2027 and 2030. “Given the steady uptake over the last three years, we can already foresee that in the years 2027 to 2030 these companies will again be able to rotate with minimal disruption to the audit profession, and without any hindrance to the companies, as Audit Committees can already be sure to limit the procurement of prohibited services from any firm they may wish to rotate to in future. The forward planning for these companies will be made easier by the fact that not many companies will be rotating in those years.” The latest statistics show that 18 companies rotated in 2017 right after the promulgation, and 2018 and 2019 saw 34 and 32 rotations respectively. Says Agulhas: “The important thing to bear in mind is that there are only three years left for voluntarily early rotation and 75% of companies have yet to rotate and a large percentage of these with audit firm tenure exceeding ten years at 1 April 2023 will be required to rotate in that year or the year prior, depending on the company year end. “This naturally suggests that audit firm rotation should pick up in number of rotations per year over the next 18 months as audit committees attempt to avoid a mass rotation in the period 2022-2023. We would fully expect that by next year there will be between 60 and 100 rotations in the one-year cycle. “The reason for this is that audit committees will want to avoid the additional pressure of a large number of rotations in the final months before the effective date, as it could impact the selection and appointment process. Audit committees which are waiting until late 2022 or 2023 to execute the required rotation may want to plan for an extended lead in period for the request for proposal, selection and appointment process, as the audit firms which they may prefer will be responding to numerous new business acquisition requests or may have already been appointed by a significant competitor in the same sector. Naturally some companies may not wish to be in the same stable as a significant competitor and so therefore preferred choices at that time may be eliminated automatically because of conflicted interests. “For those audit committees which have not yet formulated their planned rotation, the IRBA suggests that this should become a priority to finalise in the next few months; at least to establish a target date for the actual rotation of the audit, at a time which is least inconvenient for the company.” Ends

More about the IRBA: The IRBA is a public protection statutory body established to protect the financial interests of the public by ensuring registered auditors and their firms deliver services of the highest quality. It upholds audit firm independence to ensure that audit quality is such that it enhances the accuracy and credibility of financial performance reporting. In this way, the IRBA has an important role to play in building the reputation of South Africa as an investment market for both local and global investors and driving economic growth for the country. The IRBA also registers suitably qualified accountants as auditors, who must adhere to the highest ethics standards, and promotes the auditing profession through the effective regulation of assurance conducted in accordance with internationally recognised standards and processes.

|